Naya Pakistan Certificates: The Government of Pakistan has offered the overseas Pakistanis an attractive opportunity to invest their money in Pakistan by introducing Naya Pakistan Certificates. These saving certificates have already attracted a huge investment from overseas Pakistanis.

Here’s how to invest in Naya Pakistan Certificates, Now the overseas Pakistanis and resident Pakistanis having assets abroad can invest in Naya Pakistan Certificates with attractive returns over different maturities.

NPCs are sovereign instruments, denominated in dollar and rupee, issued by the government and can only be purchased through Roshan digital accounts. Resident Pakistanis who have declared their assets abroad can also invest in USD denominated NPCs.

The investors can avail this opportunity through the partnering banks only.

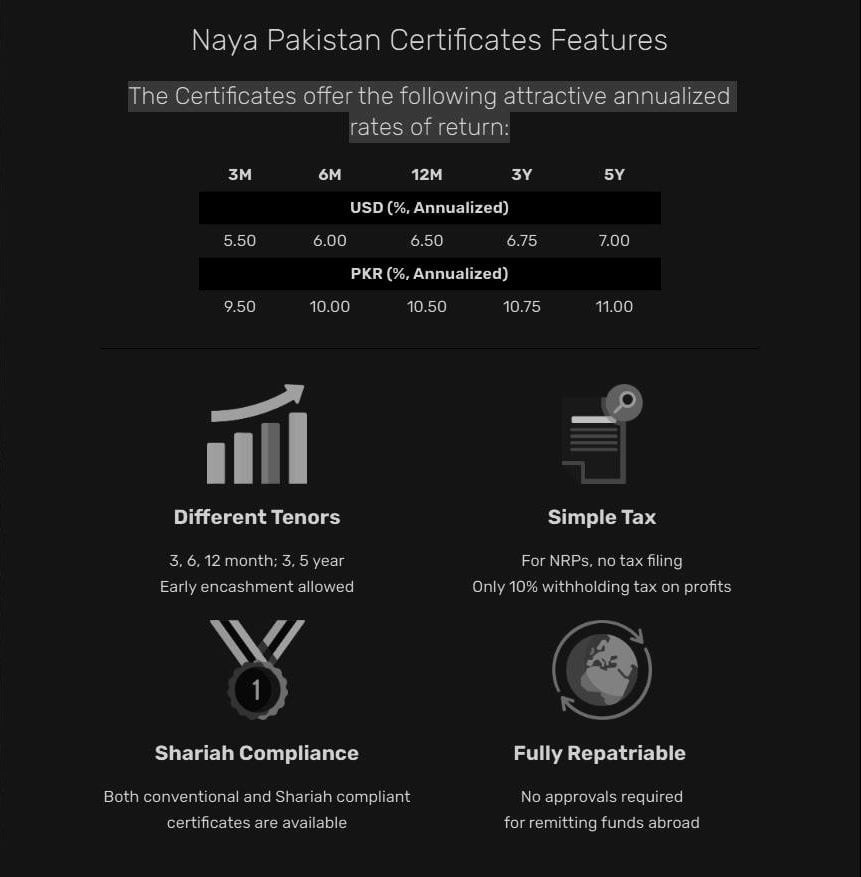

Naya Pakistan Certificates Features

The Saving Certificates offer the following attractive annualized rates of return:

Who can invest in NPCs

- Non-Resident Pakistanis

- Resident Pakistanis with declared assets abroad

Islamic Naya Pakistan Certificates

(Shariah Compliant Version)

- INPCs are based on a Mudaraba structure whereby the investor invests in a Mudaraba pool that is used to extend financing to the Federal Government.

- Investment is remunerated from the profits earned by this pool.

- For this purpose, Federal Government has created a special purpose vehicle, Islamic Naya Pakistan Certificate Company Limited (INPCCL) fully owned by it.

- This company is housed and managed by the State Bank of Pakistan (SBP) on the basis of a mandate given by the company’s Board.

- Since INPCs are offered in both USD and PKR denomination, the company maintains separate Mudaraba pools for USD and PKR.

How Can You Invest in NPCs

Follow these simple steps and if you click on the below mentioned partnering banks it will take you to their NPCs guideline page and digital account details.

1. Open a Roshan Digital Account

- Non-Resident Pakistanis (NRPs) can invest in NPCs through their Roshan Digital Account which they can open online in a completely presence-less manner, without the need to visit any bank branch in Pakistan, or an embassy or a consulate. The account can be opened in PKR or foreign currency, or both. (Click here for details on how to open an account)

- Resident Pakistanis who have declared assets abroad with FBR can invest in USD-denominated NPCs. To do so, they can open a Roshan Digital Account in foreign currency by visiting a bank branch in Pakistan. (Click here for details)

2. Transfer Funds in Your Account

- After opening your Roshan Digital Account with the bank of your choice, you will remit funds from outside Pakistan through normal banking channels.

- Using the funds in your account, you can invest in NPCs.

3. Choose the NPC and Subscribe

- You will be able to subscribe to the certificate electronically using your bank’s online portal.

- You will need to select the currency (PKR or USD), tenor (3-month, 6-month, 1 year, 3 years and 5 years), conventional or Shariah-form, and the amount to be invested.

- The PKR-denominated NPCs can be purchased from the balance in your PKR Roshan Digital Account.

- The USD-denominated NPCs can be purchased from the balance in your foreign-currency Roshan Digital Account. If you have a foreign-currency Roshan Digital Account in a currency other than USD, your bank will debit your account by applying the exchange rate prevailing at the time of execution of the transaction.

NPCs are offered digitally through the following banks

To invest in NPCs click on any of the above Banks of your choice.

Guidelines For Eligible Resident Pakistanis

Resident Pakistanis who have declared assets abroad with FBR can open a Foreign Currency Roshan Digital Account. Through this account, among other facilities, they will be able to invest in USD-denominated Naya Pakistan Certificates, the newly-launched debt securities of the Government of Pakistan offering attractive returns over different maturities.

Opening an Account

- Physically visit participating banks. The account can be opened by visiting a branch of any of the following 8 partner banks in Pakistan: Bank Alfalah, Faysal Bank, Habib Bank, MCB, Meezan, Samba, Standard Chartered, and UBL.

- Follow the usual process. The standard account opening process for resident Pakistanis will apply.

- Provide tax return or signed affidavit. In addition to standard documents required for KYC/CDD, either (i) the latest wealth statement filed with FBR showing declaration/disclosure of assets held abroad or (ii) a signed affidavit stating the value of assets held abroad as declared in the latest wealth statement filed with FBR will be required.

- Joint account facility. The account can be opened jointly with another resident Pakistani.

Using the Account

- Feeding the Account. The account can be fed with remittances received from abroad through banking channels. Feeding on local sources is not allowed.

- Banking Services. All banking services allowed through digital channels will be available with the account e.g. internet/mobile banking, ATM/ Debit cards. The bank may also issue a checkbook to the account holder if required.

- Investments. The account can be used to invest in foreign currency-denominated debt securities of the government of Pakistan, notably the USD Naya Pakistan Certificates, as well as foreign currency deposit schemes of the banks. Profit from these investments and disinvestment proceeds can also be credited to the account.

- Payments. Transfer and payment to any person within or outside Pakistan is allowed.

- Withdrawal. Cash withdrawal is available in either foreign currency or in equivalent Pak Rupees.

- Full Repatriability. Funds in the accounts can be repatriated abroad anytime without any prior approval from SBP or the bank.

SBP Naya Pakistan Certificates

READ MORE

- How to open Roshan Digital Account for overseas Pakistanis

- All You Need To Know About Naya Pakistan Certificates (NPCs)

- SBP Service Desk Portal for Govt Markup Subsidy Housing Finance

- Raast: SBP launches DFS Pakistan’s Instant Payment System

For further information on Roshan Digital Account from State Bank of Pakistan, please visit http://www.sbp.org.pk/RDA/index.html or email at [email protected]