KARACHI: You can now pay your motor vehicle token tax online in Sindh using the Excise and Taxation Department’s website from the comfort of your homes without the need to stand in long queues.

How to pay motor vehicle token tax online in Sindh?

There are two methods to pay your vehicle’s token tax in Sindh Excise & Taxation Department, The first one is to visit 3rd flood Civic Center, Gulshan e Iqbal Karachi or the nearest National Bank of Pakistan (NBP) Branch which accept Motor Vehicle Tax

| S.R. No | Branch Name | Phone No | ADDRESS |

| 1 | Awami Markaz | 021-99240558 – 99240556 | SHAHRAH-E-FAISAL KARACHI |

| 2 | Defence Housing Society Branch | 021-35888259 – 35886334 | 15-A,Defence Housing Society Korangi Road Karachi |

| 3 | Denso Hall Branch | 021-32620769 – 32620389 | Building Dense Hall M.A.Jinnah road |

| 4 | Fatima Jinnah Road (Hub Branch) Hyderabad | 022-99200082 – 99200142 | NBP Building Fatima Jinnah Road Hyderabad |

| 5 | Kehkashan Clifton | 021-99251330 – 99251344 | D-65, Block 9, KDA Scheme 5, Kehkashan Clifton |

| 6 | Korangi Industrial Area | 021-35062491 – 35071601 | Korangi SITE Karachi (Saudabad Merg Model Colony) |

| 7 | M.A. Jinnah Road | 021-99215025 – 99215026 | Kandawala Building M.A.Jinnah Road Karachi |

| 8 | Nazimabad Branch | 021-36623612 – 36607356 | 5-A,Ist Chowrangi Nazimabad |

| 9 | PIDC House | 021-99206031 to 33 | P IDC House Dr.Ziauddin Ahmed Road Karachi |

| 10 | S.I.T.E. Karachi | 021-32567788 – 32573812 | Shopping Centre SITE,Karachi |

| 11 | Shaheed-e-Millat Road Branch | 021-34532771 – 34382569 | F/W.35-P/1,Karachi Co-operative Society Shaheed-e-Millat Road |

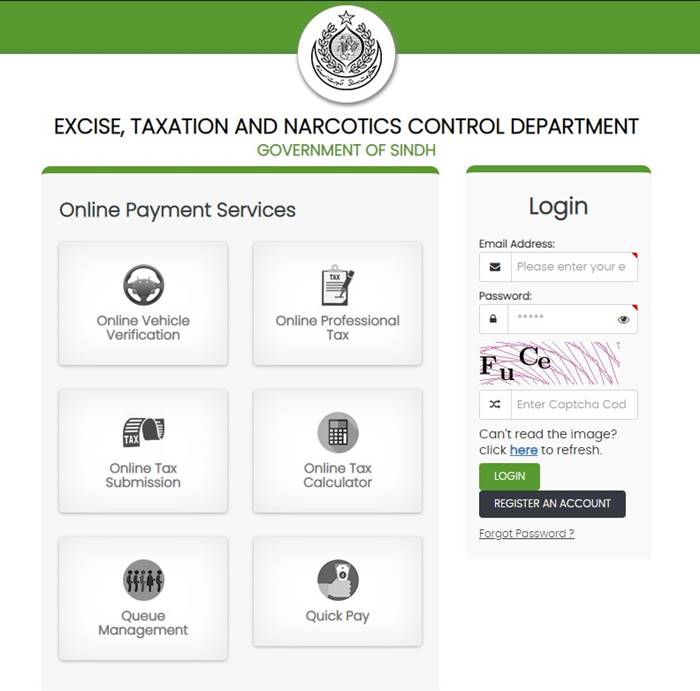

The second method is recently introduced by Excise & Taxation Department Sindh to make it more convenient for the public to pay motor vehicle token tax online via their official portal. follow the steps below to pay the token tax of your vehicle online.

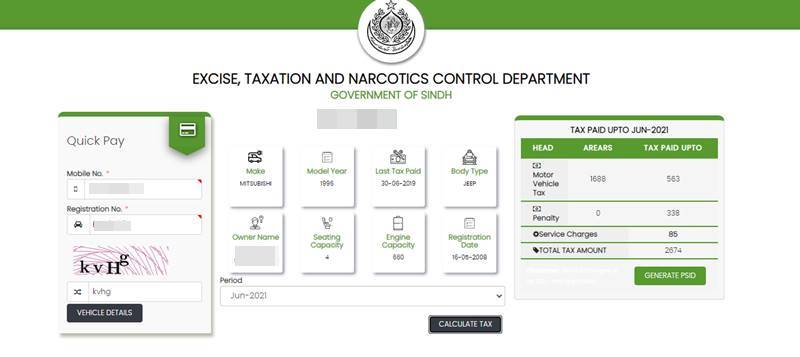

Step 1: First open the Sindh Excise and Taxation website at: https://taxportal.excise.gos.pk/ and click on ‘Quick Pay’.

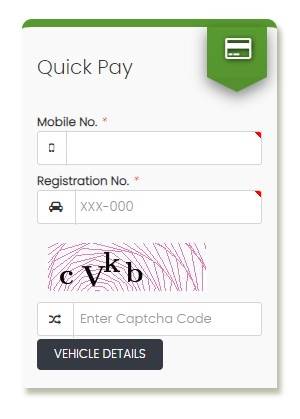

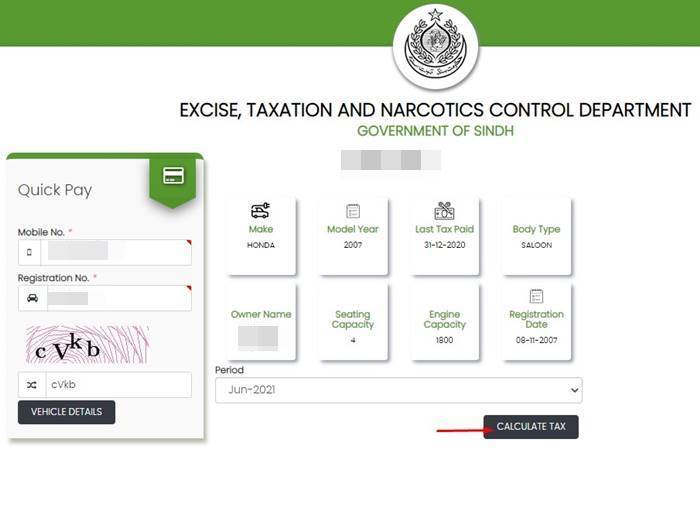

Step 2: Type in your details including phone number and motor vehicle registration number and click on ‘vehicle details’.

Step 3: Select the taxation period and click on ‘calculate tax’ and the system will show you the payable amount.

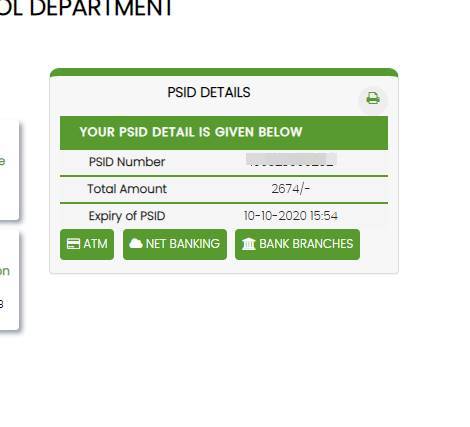

Step 4: Now ‘generate PSID’ and note it down as it will be used to pay the Sindh motor vehicle token tax. You will also receive an SMS with the PSID.

How to make Payment?

You can make payment for the motor vehicle token tax online using any one of the following channels:

Method 1: ATM Machine

- Please visit your nearest ATM of 1Link member along with ATM Card After PIN verification.

- Select the option of Tax Payment under the option of Bill Payment and select Excise & Taxation from Main Menu.

- Enter 6 digits of PSID and Press OK. Due Amount against PSID number automatically/Fetch and display on the ATM Screen.

Method 2: Internet Banking

- Log in to internet / Mobile Banking.

Select the option of Tax Payment under the option of Bill Payment and select Excise & Taxation from Main Menu. - Enter 6 digits of PSID and Press OK. Due Amount against PSID number automatically/Fetch and display on the your Screen.

- Message of successful transaction appear on the screen.

Method 3: Visit the nearest bank branch

Please visit the nearest 1Link Member bank branches along with a print of PSID and asked the trailer / Cashier to make the payment of levy against PSID, under the option of Bill Payment and select Excise & Taxation.

There is also an ePayment GoS application for Android and Apple iOS platform but does not function correctly so we did not include that in our post on how to pay Sindh motor vehicle token tax online.

If you have any further questions, please leave a comment below and we will try our best to answer in time. Furthermore, if you want to check vehicle verification online, you can download our Android app.

The Similar system has been introduced by Islamabad Excise & Taxation Department, to know further about this and the token tax information how much it tax you have to pay to visit Motor Vehicle Token Tax Islamabad 2021

INCPAK has launched Vehicle Verification Online (VVO) to check the registration information of any vehicle from Sindh, Punjab, Islamabad, Khyber Pakhtunkhwa, and Azad Kashmir, download the app from the google play store by clicking on the link below.

Follow INCPAK on | Facebook | Twitter |Instagram | for updates.

paid online tax today i.e. 06/06/2023, the tax is updated on website. How can i print the tax slip as you know traffic police ask for the tax slip.

You must have entered the email address, check your email

Message not received for print out the receipt

Dear Sir,

I have paid tax of my two vehicles BTB 858 (Daihatsu Mira) and KW 6363 (Toyota Hilux Vigo) but don’t know how to get TAX STICKERS for same. Your kind assistance will be highly appreciated.

Thanks and best regards / Aftab Ahmed.

Dear Aftab,

First of all never give your personal information online anywhere like this specially in comments, we have deleted the information.

Secondly, If you have paid the tax there is no need to update us, we have just provided the information guide how to pay your token tax.

There is nothing more we can do since we are not a government institution.

Paid my vehicle Tax up to 30.6.23 -AMN 082

However no message received to print out the payment receipt.

Kindly arrange to send the message as such can print out the PDF accordingly for record purposes.

How to change the mobile number applied in registration of vechile.

please visit Excise and Taxation Office

I paid my tex until June 2022 but I can’t print the receipt because the link comes to my normal phone not smart phone so how I can download the receipt?

I have paid the motor vehicle tax using Quick pay. I have received the SMS with a link to download the payment receipt but the link says I don’t have permission to download it. How do I download my receipt?

I think paid upto tax will be updated within a week or so, you really don’t need a receipt, in that case, it if doesn’t reflect in online record, contact excise & taxation department.

how can make invoice of token invoice because bank demond invoice they need hard copy,, Is there is special invoice or simply work??

After going through whole process of registration and ultimately reaching at PSID. The system does not do so. because message appears that ” Vehicle is issued NOC and 2020 tax is recoverable”

I dont know what is problem, last year i paid this tax with bank, whatever amount they printed on challan i paid.

so where is the issue now? unable to ustand it. The system must move ahead to resolve the issue, if any. but stopping then and there.

You need to visit Excise & Taxation Office with written appliccation and meet ETO there, issue will be resolved.

Assalam-U-Alekum

I am residing in Islamabad having a sindh number plate vehicle so if i deposit online, how can i satisfy LEAs here in Islamabad that I have paid my tax as they don’t have access of sindh excise system.

once you pay the token tax online you have the transaction SMS and after sometime it will appear online use vehicle verification online by INCPAK or Sindh Govt provided smartphone app, take a screenshot of your vehicle’s last token tax paid to show LEAs.

Sindh govt needs to implement (Email Challan copy via email in a PDF format which owners can print) unfortunately this system does not exist in their knowledge but we have forwarded our suggestion hope they will look into this matter.

Meanwhile, the best option is to pay online and stay updated from your end, verification LEAs can do themselves.

Please note after paying Online tax it will take 10 working days to appear from Sindh Excise department to update online information.

Can we pay it from other provinces or cities etc, Punjab/Lahore?

Yes, you can pay vehicle token tax from the app from anywhere in Pakistan.

Aoa,

After paying road tax online, how will I get the sticker token to paste on the wind screen of the car, how will I get the payment receipt, how will I get my car book entry. What will I show to the constable on road to prove that I paid the road tax.

Awaiting your reply.

Thank you.

basically you don’t need sticker, printed challan copy anymore, once it is paid they can check it from their system.

and the point you never show your documents or challan copy to a constable until and unless there is an officer on duty.

if there is officer assigned to check documentations he must be having a system to check them.