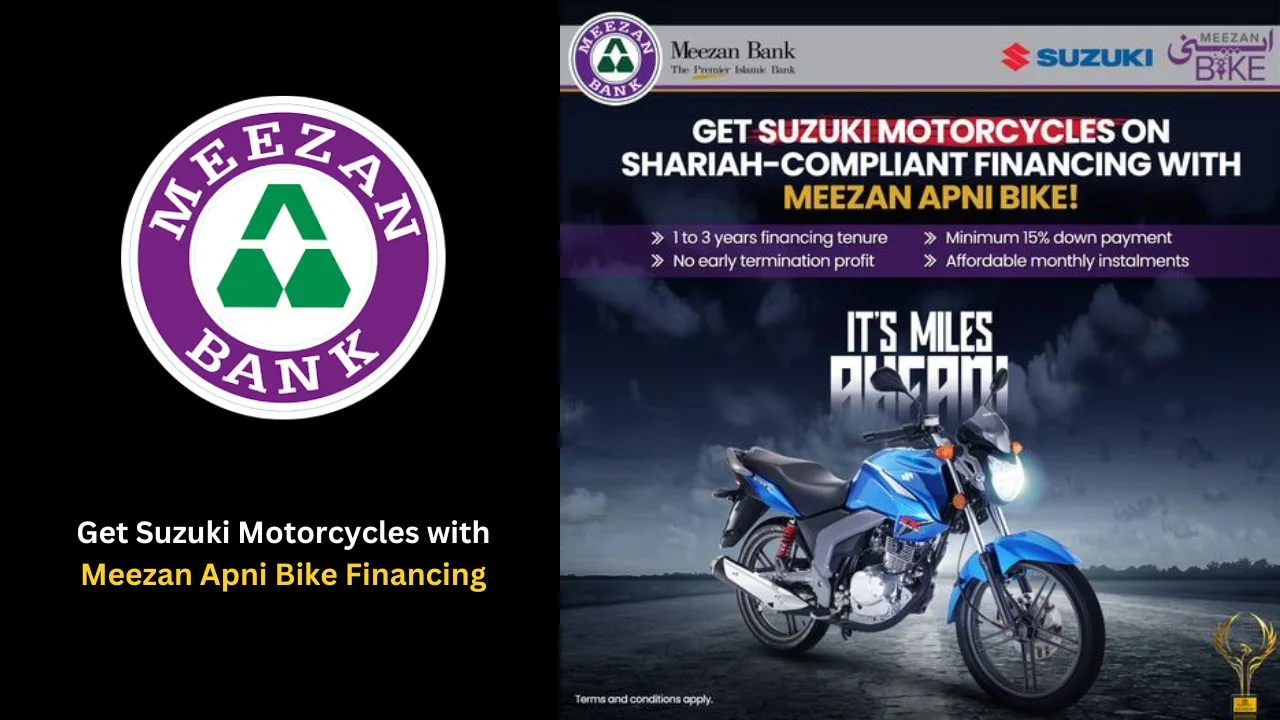

Meezan Apni Bike Financing (aka Installment Plans) offers you the chance to purchase a motorcycle based on Islamic Financing mode of Musawamah. In Musawamah Financing, the seller does not disclose the price paid to create or obtain the goods.

It is ideal for individuals who wish to avail Shariah-compliant bike financing on easy monthly installments in addition to a number of other features.

Meezan Apni Bike Financing

Meezan Apni Bike Financing works on the Shariah-compliant mode of Musawamah, which means that bank purchases the vehicle from the market and sells it to the customer on mutually agreed easy monthly installments (payments) that payable over a selected tenure.

Key Features & Benefits

- Mode of Financing : Musawamah

- Ownership : The ownership is transferred to the customer immediately after signing delivery order by customer

- Product Offering : All Honda, Suzuki, Yamaha, Super Power & Other Motorcycle variants

- Facility Tenure : The scheme is available for 1, 2 & 3 years

- Down Payment : Minimum 15% of cost of the vehicle and Maximum 50% of cost of the vehicle

- Facility Available in : Karachi, Lahore, Faisalabad, Peshawar, Rawalpindi, Islamabad and other cities

- Processing and / Documentation Charges : Non-refundable processing fee of PKR 1,800/- will be charged whereas documentation charges will be charged at actual

- Mode of Payment : Direct debit from customer’s Meezan Bank account

- Early Termination : No early termination profit

How is Meezan Apni Bike Shariah-compliant?

Meezan Apni Bike, designed under the supervision of Meezan Bank’s Shariah Board is based on Musawamah – a Shariah-compliant mode of financing.

Under this mode of financing, the bank purchases the bike from the market and subsequently sells it to the customer on a mutually agreed price payable in installments. After execution of the Musawamah contract, the ownership and liabilities pertaining to the motorcycle fall to the customer, who will be liable to pay installments over a tenure of facility.

How to Apply for Meezan Apni Bike Financing?

To apply for Meezan Bank’s Apni Bike Financing, fill out a customer application form (available at selected branches), attach the required documents and get your financing approved in 5-7 working days. After asset financing approval, the selected Bike will be available as per manufacturer’s defined time period.

Required Documents

- Copy of Applicant’s CNIC (Computerized National Identity Card)

- One Passport-sized color photograph of the applicant

- Declaration of Financing

- Signature Verification Form

Specific Requirements

For Salaried Individuals

- Original / Certified copy of Bank Statement (last 6 months)

- Original / Certified copy of Pay Slip

- Employer’s certificate including Tenor /Designation /Salary

For Businessmen / SEP

- Original / Certified copy of Bank Statement (last 12 months)

- 2 years Proof of Business (e.g. Tax return / Bank Certificate/ any other document)

Eligibility

The individual applying for the Meezan Apni Bike Financing must fulfil the following criteria:

Age

- 20 years to 65 years of age at the time of maturity (Businessmen & Self-Employed Professionals)

- 21 years to 60 years of age at the time of maturity (Salaried Individuals)

Minimum Income Requirements

- For salaried individuals – Minimum 40,000/- (Gross Salary)

- For self-employed individuals – Minimum 75,000/-

- For businessmen – Minimum 75,000/-

Debit Burden Ratio

40% of net monthly income (For Salaried, Self-Employed-Person and Businessmen)

Down Payment

Minimum 15% of cost of the vehicle and Maximum 50% of cost of the vehicle.

Tenor

- 1, 2 and 3 years

- Japanese Bikes – Tenor is 3 years

- Chinese Bikes – Tenor is 2 years

Payment Mode

Direct debit from customer’s Meezan Bank account

Eligibility Requirements for 250CC Bikes

Meanwhile, the eligibility criteria is slightly different if you’re planning on purchasing a motorcycle with an engine displacement of 250CC.

Minimum Income Requirements

- Salaried Class – 150,000/- (Gross Salary)

- Businessmen – 200,000/-

Down Payment

Minimum 30% of cost of the vehicle and Maximum 50% of cost of the vehicle

Debt Burden Ratio

Up to 40% of net monthly income /- (For Salaried and Businessmen)

Application Procedure for Meezan Apni Bike Financing

- Fill out a customer application form (available at any Branch)

- Attach the required documents and submit your application with Rs. 1,800 (Non-refundable processing fee)

- Get your financing approved in a 5-7 working days

For more information on the Meezan Apni Bike Financing or to calculate your monthly installment for any motorcycle that you’re planning to purchase under the scheme, please visit Meezan Bank’s official website.

Read more about other installment plans in our Automotive Section.

If you’re interested, you may also check out the installment plan for Honda CG 125 in Pakistan.

Read more: Honda CG 125 2023 Installment Plan – Zero Markup.

Follow INCPAK on Facebook / Twitter / Instagram for updates.