NayaPay and SadaPay are two of the latest entrants in the banking sector and operate under an Electronic Money Institution (EMI) license issued by the State Bank of Pakistan (SBP) after meeting certain regulations for EMIs. In this article, we have done a brief comparison of both services, NayaPay vs SadaPay, to make it easier for everyone to decide amongst both these digital banking services.

There are many people who confuse NayaPay and SadaPay with services like JazzCash and EasyPaisa, which are completely different and fall under the Microfinance Bank (MFB) category by the State Bank of Pakistan. However, SadaPay and NayaPay fall under the Electronic Money Institution (EMI) category.

What is the difference between EMI and Microfinance Bank?

Electronic Money Institution (EMI) is a non-banking entity which is authorized to issue means of payments in the form of electronic money, offering innovative, user-friendly, and cost effective digital payment prepaid instruments like wallets, prepaid cards, and contactless payment instruments, including wearables. However, Microfinance Banks are actual banking entities registered with the State Bank of Pakistan.

SadaPay vs NayaPay

SadaPay and NayaPay are categorized as EMI and operate under a non-banking entity with an EMI license issued by the State Bank of Pakistan (SBP), while EasyPaisa and JazzCash are products of Mobilink Microfinance Bank and Telenor Microfinance Bank.

SadaPay

SadaPay is an EMI which is registered as SadaTech Pakistan Pvt Ltd with the Securities and Exchange Commission of Pakistan (SECP) and it is regulated by the State Bank of Pakistan (SBP). SadaPay offers a number of banking services, including a digital wallet, money transfers, physical and virtual debit card, and bill payment options as well.

Pros

- Physical Debit Card is Numberless

- Virtual Debit Card Option for Online Payments

- Free Physical and Virtual Debit Cards

- No Annual Fees

- 3 Free ATM Withdrawals Per Month

- Completely Free IBFT Transfers

- In-App Control Over Debit Cards

- Live Chat Support

- Bank-Linking Option to Transfer Money Quickly

Cons

- Long Waitlist

- Referral System

- No Mobile Top-up Option

- Biometric Verification at E-Sahulat (Rs. 120 are charged by agent and later refunded by SadaPay into account)

If you want to signup for SadaPay, click on the Link below:

Sign-Up For SadaPay

NayaPay

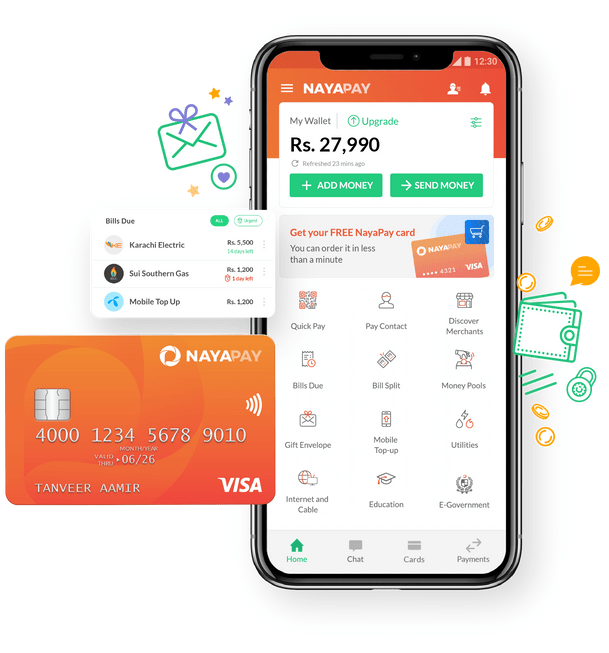

NayaPay is also an EMI registered under NayaPay (Private) Limited and operating under a license from the State Bank of Pakistan. NayaPay offers usually banking services, including money transfers, physical and virtual debit card, and bill payment options.

Pros

- Free Physical and Virtual Debit Card

- No Waitlist

- No Annual Fees

- Free IBFT Transfers

- Over-the-Counter Cash Deposit at any Meezan Bank or Askari Bank Branches

- Biometric Verification at any Meezan Bank ATM (FREE)

- In-App Control Over Debit Cards

Cons

- No iOS support

If you want to signup for NayaPay, click on the link below:

Sign-up For NayaPay

If you have anymore questions regarding NayaPay or SadaPay, leave a comment down below and we will try and answer it.

Read more: Dollar Rate in Pakistan (Daily Updates).

Follow INCPAK on Facebook / Twitter / Instagram for updates.