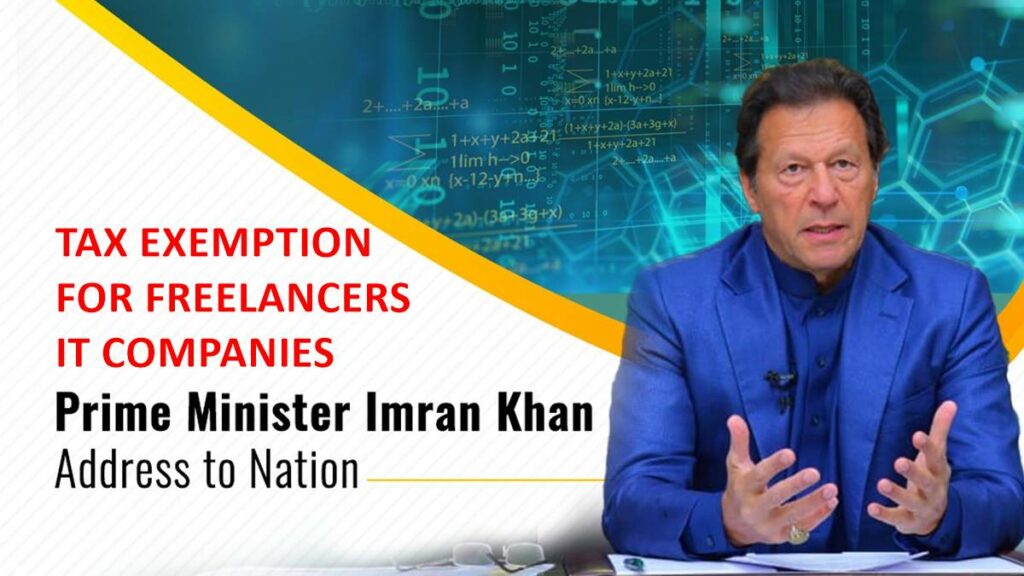

In his address to the nation on 28th February, Prime Minister Imran Khan announced complete tax exemption for the Information Technology (IT) sector, including companies and freelancers.

According to Prime Minister Imran Khan, there will be a 100% tax exemption for IT companies and freelancers alongside easing foreign exchange restrictions for the IT industry as well.

Prime Minister @ImranKhanPTI announces historic incentives to boost IT sector.

— Prime Minister's Office, Pakistan (@PakPMO) February 28, 2022

✔️100% tax exemption for both companies and freelancers

✔️100% foreign exchange exemption

✔️100% exemption from Capital gain tax for investments in IT start ups. pic.twitter.com/DF5EameZLo

The announcement comes shortly after the premier approved reforms in the IT sector in order to facilitate starts-ups and freelancers.

The reforms include complete tax exemption for IT freelancers and companies along with several other fiscal and non-fiscal incentives.

The official document released in this regard state, “Tax exemption for IT/ITES firms and freelancers for five years to be implemented through amending the Income Tax Ordinance 2001 by April 2022.”

It bears mentioning that the IT sector suffered double taxation as its services were charges taxes at the business level as well as at the individual level when the profits were distributed to shareholders.

The proposed reforms will help to resolve this issue by onboarding all stakeholders in the IT industry.

Furthermore, the government has allowed IT companies and freelancers to retain 100 percent of remittances received through proper banking channels in foreign currency (FCY) accounts without any compulsion to convert them into PKR.

Moreover, the government will allow outward remittance form FCY account for IT companies and freelancers registered with the Pakistan Software Export Board (PSEB) by lifting restrictions.

Prime Minister Imran Khan has also directed the State Bank of Pakistan (SBP) to introduce financing streams for the IT/ITES sector and freelancers keeping in view operational architecture and industry needs for these sectors. It bears mentioning that the proposed reforms suggest use of registered companies or professionals’ USD balance as collateral for financing.

Additionally, there will be certain sectors of Islamabad which will be declared as Special Technology Zones after which a similar concept will be replicated in Lahore, Karachi, and Quetta.

The reforms will also launch the Pakistan Technology Startup Fund for the creation of a public-private partnership venture capital fund. The fund will be created under the National Technology Fund (IGNITE).

The IT industry has generated more than $2 billion in revenue in the last fiscal year and as per the Ministry of Information Technology and Telecommunication (MOITT), Pakistani freelancers alone generated $216.788 million by exporting their services in the first half of the fiscal year 2021-22 (July to December 2021), an increase of 16.74 per cent from the same period last year.

The reforms are an attempt by the government to encourage IT companies and freelancers to bring their foreign remittance in Pakistan rather keeping it in their offshore accounts, while also encouraging foreign businesses to invest in Pakistan and local startups in order to help create jobs.

Read more: PM Khan Announces Skill-Based Internships Worth Rs. 30,000 Per Month.