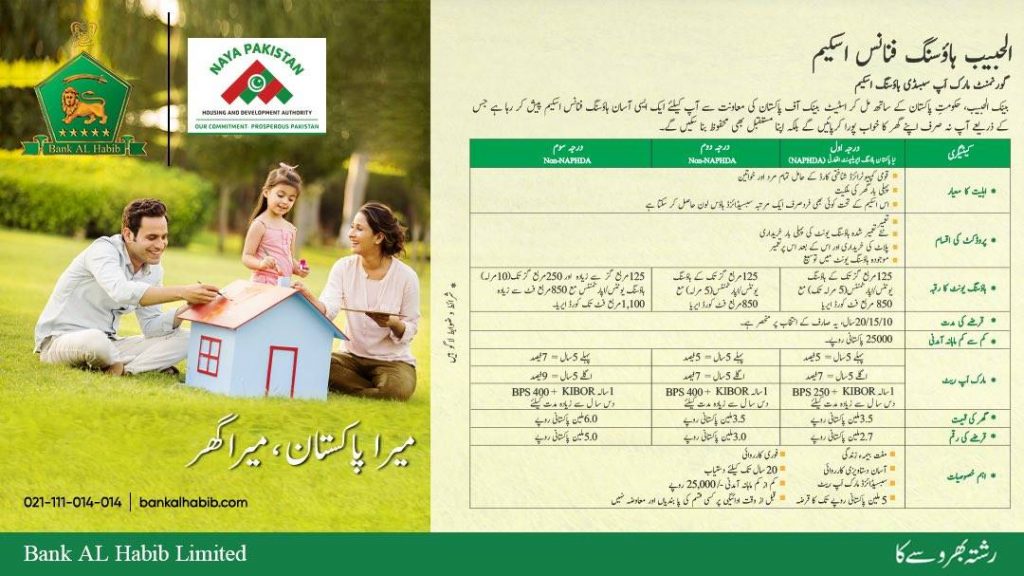

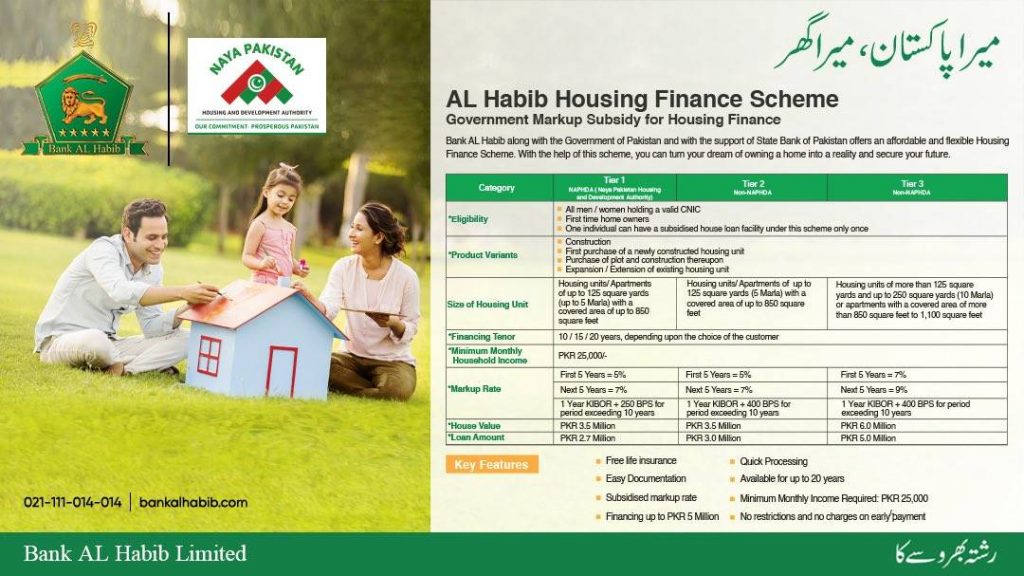

Bank Al Habib Mera Pakistan Mera Ghar offers an easy and affordable house financing scheme. Bank Al Habibi like other banks with the support of the Government of Pakistan and State Bank of Pakistan can materialize the dream of owning a house with their flexible Housing Finance Scheme.

The customers can avail the Bank Al Habib Mera Pakistan Mera Ghar through their conventional and Islamic Banking branches.

All Pakistani nationals holding valid CNIC can avail this opportunity and turn their dream into reality. The total financing offered by Bank Al Habib is upto PKR 5 million with subsidized Mark Up Rate.

Monthly income required to avail loan under Mera Pakistan Mera Ghar Scheme is as low as PRK 25,000/- only and both salaried and non-salaried individual falling in the age bracket of 25 years to 60 years are eligible for this Hosing Finance Loan Facility.

READ MORE: Mera Pakistan Mera Ghar Loan Application [Complete Information]

The details pertaining to Bank Al Habib Mera Pakistan Mera Ghar Scheme is listed below:

Table of contents

Key Features

- Free Life Insurance

- Subsidized Markup Rate

- Financing up to PKR 5 Million

- Minimum Monthly Income Required: PKR 25,000/-

- Available for up to 20 years

- Easy Documentation

- Quick Processing

- No restrictions and no charges on early repayment

Eligibility Criteria

- All men/women holding valid CNIC.

- First-time homeowner, one unit per household.

- One individual can have a subsidized house loan facility under this scheme only once.

- Minimum Monthly Income Required: PKR 25,000/-

Product Variants

- Construction

- First purchase of newly constructed housing unit

- Purchase of plot and construction thereupon

- Expansion / Extension of the existing housing unit

Age (Applicant & Co-applicant)

- 25 to * 60 years

*at maturity

Financing Tenor

- 10 / 15 / 20 years, depending upon the choice of the customer

Early Repayment

- No restrictions and no charges on early repayment

Insurance

- Property Insurance

- Free Life Insurance

Frequently Asked Questions

What is the Parameter & Project Scheme?

| Parameter | Project Scheme |

| Tier 1 | Naya Pakistan Housing Development Authority (NAPHDA) |

| Tier 2 | Non – NAPDHA /Single House/Unit |

| Tier 3 | Non – NAPDHA /Single House/Unit |

What is the Size of Housing Unit?

| Parameter | Size of Housing Unit |

| Tier 1 | Housing unit/apartment of up to 125 square yards (up to 5 Marla) with a covered area of up to 850 square feet. |

| Tier 2 | Housing unit/apartment of up to 125 square yards (5 Marla) with a covered area of up to 850 square feet |

| Tier 3 | Housing unit/apartment of more than 125 square yards and up to 250 square yards (10 Marla) or covered area from more than 850 square feet to 1,100 square feet. |

What is the Subsidy Profit/Mark-up Rate?

| Parameter | End User Pricing (Subsidy Rate) | Bank Pricing |

| Tier 1 | First 5 Year 5% Next 5 Year 7% | 1 Year KIBOR + 250 BPS for a period exceeding 10 years |

| Tier 2 | First 5 Year 5% Next 5 Year 7% | 1 Year KIBOR + 400 BPS for a period exceeding 10 years |

| Tier 3 | First 5 Year 7% Next 5 Year 9% | 1 Year KIBOR + 400 BPS for a period exceeding 10 years |

What is the Maximum Price of Unit ?

Market value of a single housing unit at the time of approval of financing is as under:

| Parameter | House Value |

| Tier 1 | PKR 3.5mn |

| Tier 2 | PKR 3.5mn |

| Tier 3 | PKR 6.0mn |

What is the Financing Range ?

| Parameter | Loan Amount |

| Tier 1 | PKR 2.7mn |

| Tier 2 | PKR 3.0mn |

| Tier 3 | PKR 3.0mn |

READ MORE: Naya Pakistan Housing Scheme: First Pre-Fabricated House inaugurated

Documents Required

For Non-Salaried Individuals

- Standardized Loan Application Form

- Valid CNIC of applicant & co-applicant (where applicable)

- 2 recent color photographs (passport size) of applicant & co-applicant (where applicable)

- Minimum 3 years proof of business for business individuals and 2 years proof of business for SEP (self employee professional)

- Acceptable income proof (e.g. NTN Certificate/Tax Returns / Bank Certificate) or any other valid business proof which may be acceptable to the bank

- Account maintenance certificate and last 6 months Bank Statement(s)

For Salaried Individuals

- Standardized Loan Application Form

- Valid CNIC of applicant & co-applicant (where applicable)

- 2 recent color photographs (passport size) of applicant & co-applicant (where applicable)

- Minimum 2 years employment period

- Latest Salary Certificate / Employment Letter mentioning employment details and joining date

- Salary slip of last month

- Account maintenance certificate and last 6 months Bank Statement with reflection of salary credits

Contact

For more details

- Visit http://bankalhabib.com

- Call us at 111-014-014

Hi,

I would like to have precise list of house document required by Bank.

Thankyou,

Only the bank can provide you the information.