Islamabad Vehicle Token Tax Information by Excise & Taxation Department Islamabad, now you can pay Token Tax Online using Islamabad City app using your smartphone.

Public Announcement

![Motor Vehicle Token Tax Islamabad 2020 [Update]](https://i2.wp.com/incpak.com/wp-content/uploads/2020/07/75135947_3364772620221385_746709336989610686_o.jpg?fit=845%2C1024&ssl=1)

Islamabad Excise and Taxation Department Office Address

Deputy Commissioner Islamabad said “To resolve the problem of long queues on the collection of tokens of vehicles in Excise and Taxation Department Office and Islamabad Capital Territory (ICT) Administration has issued an order to keep the department opened from 9 am to 8 pm. Citizens can submit fee at the Excise office at any time throughout the day.”

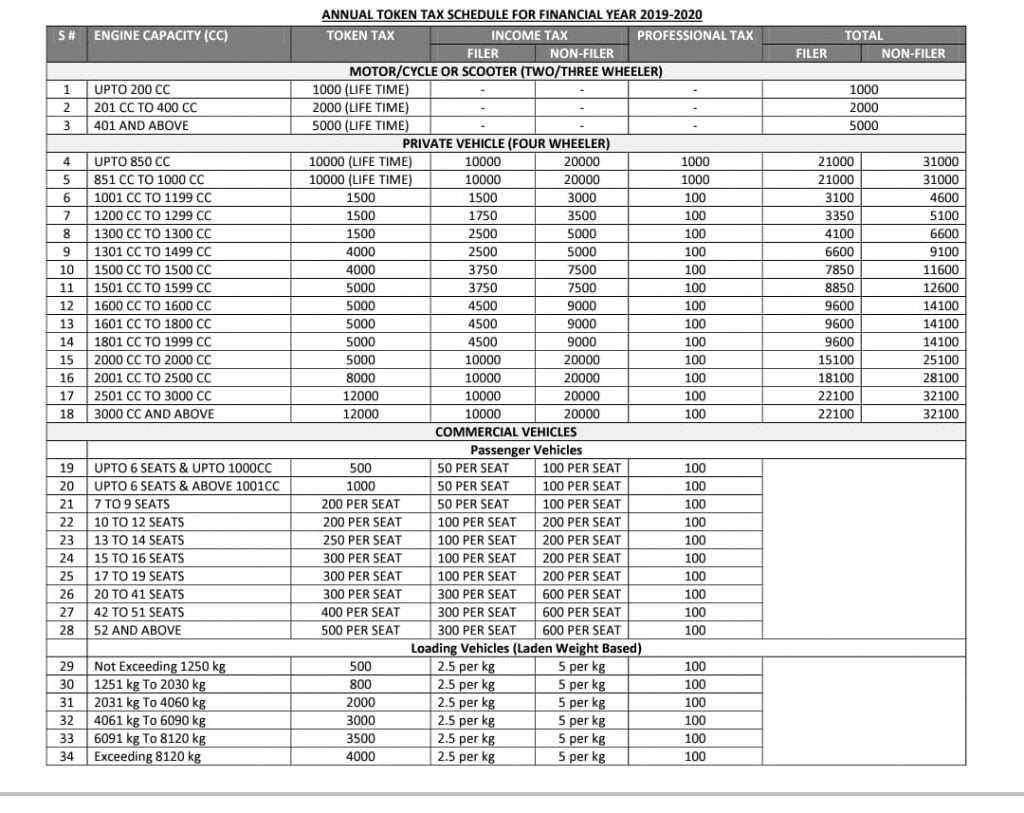

We at Independent News Coverage Pakistan (INCPAK) been receiving your emails regarding Token Taxes, how much you have to pay so here’s the chart below which will help you understand.

Pay Sindh Registered Motor Vehicle Token Tax Online

A similar system has been introduced by Excise & Taxation Department Sindh to pay Vehicle Tax/Token Tax online, we have briefly mentioned the steps how to pay your vehicle’s token tax online and by visiting the nearest National Bank of Pakistan (NBP) Branches.

Pay Motor Vehicle Token Tax Sindh [Complete Guide]

Pay Punjab Registered Motor Vehicle Token Tax Online

Excise & Taxation Department of Punjab has introduced an Online system to pay Motor vehicle token tax online, we have gathered the information to make it more convenient for us visitors to understand how to pay the token tax amount online.

Islamabad Token Taxes 2020-2021

Taxes information on Islamabad registered vehicles is here. Taxes include Motor Vehicle Registration fee, ADVANCE TAX – NEW VEHICLES, Motor Vehicle Transfer fee, Token fee, income tax, Luxury Tax, Fee of Choice Number Plates. Check taxes on every type of vehicle here.

REGISTRATION FEE

| Vehicle Category | Engine Capacity | Value of vehicle |

| Private / Government | 999 cc and Below | 01 % |

| Private / Government | From 1000 cc to 1999 cc | 02 % |

| Private / Government | 2000 cc and Above | 04 % |

| Commercial | 999 cc and Below | 01 % |

| Commercial | 1000 cc and Above | 02 % |

ADVANCE TAX – NEW VEHICLES

| Engine Capacity | Filer (In Rs.) | Non-Filer (In Rs.) |

| Upto 850 cc | 10,000 | 20,000 |

| From 851 cc to 1000 cc | 20,000 | 40,000 |

| From 1001 cc to 1300 cc | 30,000 | 60,000 |

| From 1301 cc to 1600 cc | 50,000 | 100,000 |

| From 1601 cc to 1800 cc | 75,000 | 150,000 |

| From 1801 cc to 2000 cc | 100,000 | 200,000 |

| From 2001 cc to 2500 cc | 150,000 | 300,000 |

| From 2501 cc to 3000 cc | 200,000 | 400,000 |

| Above 3001 cc | 250,000 | 500,000 |

ADVANCE TAX – ON TRANSFER

| Engine Capacity | Filer (In Rs.) | Non-Filer (In Rs.) |

| Upto 850 cc | NIL | NIL |

| From 851 cc to 1000 cc | 5,000 | 10,000 |

| From 1001 cc to 1300 cc | 75,00 | 15,000 |

| From 1301 cc to 1600 cc | 125,00 | 25,000 |

| From 1601 cc to 1800 cc | 18,750 | 37,500 |

| From 1801 cc to 2000 cc | 25,000 | 50,000 |

| From 2001 cc to 2500 cc | 37,500 | 75,000 |

| From 2501 cc to 3000 cc | 50,000 | 100,000 |

| Above 3001 cc | 62,500 | 125,000 |

TOKEN TAX

| Vehicles Catagories | Engine Capacity/Seats | Amount (in Rs.) |

| MOTORCYCLE AND SCOOTER (Two/Three Wheeler Vehicles) | ||

| Motorcycle/Scooter | Upto 200 cc | 1,000 (Lifetime) |

| —— | 201 cc to 400 cc | 2,000 (Lifetime) |

| —— | 401 cc and Above | 5,000 (Lifetime) |

| FOUR WHEELER VEHICLES | ||

| Private / Government | Upto 1000 cc | 10,000 (Lifetime) |

| —— | From 1001 cc to 1300 cc | 1,500 |

| —— | From 1301 cc to 1500 cc | 4,000 |

| —— | From 1501 cc to 2000 cc | 5,000 |

| —— | From 2001 cc to 2500 cc | 8,000 |

| —— | From 2501 and Above | 12,000 |

| COMMERCIAL VEHICLES | ||

| MOTTOR CAB Having Upto 6 Seats | Upto 1000 cc | 600 |

| —— | From 1001 cc and Above | 1,000 |

| Public Service Vehicles | From 8 Seats to 12 Seats | 200 Per Seat |

| —— | From 13 Seats to 14 Seats | 250 Per Seat |

| —— | From 15 Seats to 16 Seats | 300 Per Seat |

| —— | From 17 Seats to 41 Seats | 300 Per Seat |

| —— | From 42 Seats to 51 Seats | 400 Per Seat |

| —— | From 52 and Above | 500 Per Seat |

| Loading Vehicles / Goods Vehicles | Laden weight not exceeding 1250 kg | 500 |

| —— | Laden weight exceeding 1250 kg but not exceeding 2030 kg | 800 |

| —— | Laden weight exceeding 2030 kg but not exceeding 4060 kg | 2,000 |

| —— | Laden weight exceeding 4060 kg but not exceeding 6090 kg | 3,000 |

| —— | Laden weight exceeding 6090 kg but not exceeding 8120 kg | 3,500 |

| —— | Laden weight exceeding 8120 kg | 4,000 |

INCOME TAX

| Vehicle Catagory | Engine Capacity | Filer (in Rs.) | Non-Filer (in Rs.) |

| Private | Upto 850 cc | 10,000 | 20,000 |

| Private | From 851 cc to 1000 cc | 10,000 | 20,000 |

| Private | From 1001 cc to 1199 cc | 1,500 | 3,000 |

| Private | From 1200 cc to 1299 cc | 1,750 | 3,500 |

| Private | From 1300 cc to 1499 cc | 2,500 | 5,000 |

| Private | From 1500 cc to 1599 cc | 3,750 | 7,000 |

| Private | From 1600 to 1999 cc | 4,500 | 9,000 |

| Private | From 2000 and Above | 10,000 | 20,000 |

| Commercial | loading Pickup/Mini Truck/Truck | Rs. 2.50 per Kg | Rs. 5.00 per Kg |

| Commercial | Pessenger Vehicle (Upto 9 Seats) | 50 per Seat | 100 per Seat |

| Commercial | Pessenger Vehicle (10 to 19 Seater) | 100 per Seat | 200 per Seat |

| Commercial | Pessenger Vehicle (20 & More Seater) | 300 per Seat | 600 per Seat |

TRANSFER OF OWNERSHIP FEE

| Vehicle Category | Engine Capacity | Amount (In Rs.) |

| Private / Commercial | Upto 1000 cc | 1,200 |

| Private / Commercial | From 1001 cc to 1800 cc | 2,000 |

| Private / Commercial | Above 1801 cc | 3,000 |

HPA FEE

| Vehicle Category | Engine Capacity | Amount (In Rs.) |

| Private / Commercial | Upto 1000 cc | 1,200 |

| Private / Commercial | From 1001 cc to 1800 cc | 2,000 |

| Private / Commercial | Above 1801 cc | 3,000 |

HPT FEE

| Vehicle Category | Engine Capacity | Amount (In Rs.) |

| Private / Commercial | Upto 1000 cc | NIL |

| Private / Commercial | From 1001 cc to 1800 cc | NIL |

| Private / Commercial | Above 1801 cc | NIL |

PROFESSIONAL TAX

| Vehicle Category | Amount (in Rs.) |

| Commercial loading Pickup | 100 |

| Commercial Mini Truck / Truck | 100 |

LATE FEE

| Time Period (Staring from invoice date/Bill of Entry date/Auction date) | Amount (in Rs.) |

| More than 02 months (60 days) and less than 06 months (180 days) | 2,000 |

| More than 06 months (180 days) | 5,000 |

SPECIAL NUMBER FEE

| REGISTRATION NUMBERS | Amount (in Rs.) |

| MOTORCYCLE (PRIVATE) | |

| 001, 005, 007, 123, 125, 786 | 5,000 |

| 002, 003, 004, 006, 008, 009 | 1,000 |

| 011, 022, 033, 044, 055, 066, 077, 088, 099 | 500 |

| 111, 222, 333, 444, 555, 666, 777, 888, 999 | 1,000 |

| FOUR WHEEL VEHICLE (PRIVATE) | |

| 001 | 300,000 |

| 786 | 150,000 |

| 005, 007, 111, 555, 777 | 100,000 |

| 002, 003, 004, 006, 008, 022, 033, 044, 066, 077, 088, 099 | 26,000 |

| 222, 444, 666, 888 | 40,000 |

| 022, 033, 044, 066, 077, 088,099 | 26,000 |

| 010, 011, 012, 014, 055, 072, 092, 110, 313, 512, 514, 572, 333, 999 | 40,000 |

| 101, 200, 300, 400, 600, 700, 800, 900, 123 | 20,000 |

| 100, 500, 009 | 30,000 |

| REMAINING TWO DIGIT NUMBERS (i.e, 023, 043, 080, 093 etc.) | 5,000 |

NUMBER PLATES FEE:

| Vehicle Category | Amount (in Rs.) |

| Motor Cycle (Government) | 400 |

| Motor Cycle (Private) | 400 |

| Four Wheel Vehicle (Government) | 800 |

| Four Wheel Vehicle (Private & Commercial) | 800 |

NOTE:

- MUTUAL TRANSFER FEE: Rs. 100/- Each

- DUPLICATE / REPLACEMENT CERTIFICATE FEE: Rs. 500/- (Private / Government), Rs. 1000/- (Commercial).

- ALTERATION FEE: Rs. 1,500/-

- CHANGE OF TITLE FEE: Rs. 400/-

- RESIDENT PROOF FEE: Rs. 100/-

- SMART CARD FEE: Rs. 1,462/-

All information about the vehicle tax of Islamabad is stated above. You can also visit the official site of Islamabad Excise & Taxation Department’s official website..

Islamabad City App now provides Vehicle Token Tax Payment

Private and Commercial vehicles and Filers and Non-Filers both are mentioned for more queries kindly visit Excise and Taxation Department Islamabad.

DOWNLOAD VEHICLE VERIFICATION SMARTPHONE APP

INCPak Technologies (INCPAK TECH) also Introduces – Vehicle Verification Online Smartphone application, Download from Google Playstore now. Tax information and online verification are available theirs also. Download from the link given below.

Rs.200,000.00 have been charged as Pre Registration Advance Tax on Toyota corolla altis 1598 CC. is this ok/as per law? if so, under what section. Please guide and oblige.

*being a filer

Sir what’s the necessary documents to bring for the transfer and token payment for mehran car ..

Islamabad Excise & Taxation dept now Biometric verification you have to bring biometric verification of the seller/ Sale Letter / Transfer Letter / CNIC original and smart card or book.

AOA, Concerned officer,

New Hyundai Sonata 2497cc Value Incl. Duty & Sale tax 7,103.200 + 150000 W.H Tax total 7253200

Please Calculate Registration Charges, How many Expenses for New Registration Purchase Date 09.12.21

Your Early reply will be appricated.

Thanks & Regards.

Mian Anwar

Dear Mian Anwar,

You have shared your query on Independent News Coverage Pakistan, which is a Digital News and Information Portal,

whereas the concerned department will never going to read it over here, kindly contact the Excise & Taxation Islamabad Office.

Thank you.

I have mehran car, 796cc.model 2014.its token tax is not paid from 2014 sep.how much rupees now I deposit for lifetime token paid? Also car from bank, now I want to transfer on my name, wats procedure n total fee?

kindly visit the excise and taxation office personally.

Brother download City Islamabad App/ E pay Punjab first of all register and then login go to token tax pay option type registration Number and click pay button generate PSID id go to JAZZ CASH application and make account . Go to government fees and pay PUNJAB TOKEN EXCISE DEPARTMENT OR ISLAMABAD TOKEN TAX PAY AND pay token tex.

2010 gli ha is k token kitna k laga ga koi information

I have a bedford truck registered in Peshawar KPK, model 1977 computer number plate, make & type OIL tanker presently used as water tanker , I want to clear its token tax dues from 2016 to 2020. What is actual amount I have to pay. Moreover, I am residing at Rawalpindi, can I deposit token money at here.

Hi…2018 model wagon r 998cc…tokem tax confirm mar dey

Corolla 98 ka token lgwana hai ktni price ho gi koi info kr skta hai one year k token hai

MEhran 2003 model islamabad number. Tax paid upto 2019…

How much amount will be spend for life time token tax???

is there any differnce for filer or non filer . or same token tax for both regarding this vechle.

is there any fine now a days as last date passed..

Another Aspect of charging income tax on Cars with the road tax.When these cars

were imported, heavy custom duty, sales tax and advance income tax was charged

at the Port. Now to charge income tax again is Totally illegal, unjust and amounts to

pure blackmail.

1. Moreover cars are no more a luxury. they are necessary for the Public to

transport their families,take children to school etc.

2. Private cars are not generating any income. how you can charge income tax

on cars. already road tax is Paid in advance for the coming Years.

Administration. for ALLAH’s sake have some sense and do justice.

Sheikh Asif Rashid. No these are different comments. Please Post

Another Aspect of charging income tax on Cars with the road tax.When these cars

were imported, heavy custom duty, sales tax and advance income tax was charged

at the Port. Now to charge income tax again is Totally illegal, unjust and amounts to

pure blackmail.

1. Moreover cars are no more a luxury. they are necessary for the Public to

transport their families,take children to school etc.

2. Private cars are not generating any income. how you can charge income tax

on cars. already road tax is Paid in advance for the coming Years.

Administration. for ALLAH’s sake have some sense and do justice.

Sheikh Asif Rashid.

Is date is extended or not???

I am a long since retired govt servant surviving on a meagre pension. I

posses a 2002 Model Mehran 800cc car on which I have been paying token

tax ever sincer. Now at the age of over 80 year the Excise and Texation Department

is compelling me to Pay Rs 35000 for a life long token on a 17 year old car at

a stage where I have one leg in the grave. And there is no option. Who

ever decided this is the enemy and a killer of the poor of Pakistan and this

is happening during the rule of PTI which is a party built on justice. What

justice.

I am sure whoever decided this does not have any brain.

I am sure whoever decided this does not have any brain.

online token form for bike , i cant find

Is it true that last date for token fee has extended to 30th October 2019 ?

I have the same query

I only want to know could I pay one year tax of 800cc mehran car

now lifetime token to be paid

Salam o alikum. I wast to ask you one thing about my car token tax..I have 2018 Toyota Corolla xli ..with smart card ..I want to know that can I pay token tax to any islamabad post office or I have to pay tax to excise office ..thank you

Excise office

Sir, a.a

I m a filer.

Mery pass 800cc mehran 2018 December, wali car he, jis ki registration 23-1-2019 ki he, tax up to 30-6-2019 he,

Plz abi mujy kitna TeX (2019-2020 ) dena he, ??

Q.2. Keya 800cc ka life time tax ho sakta he, ??? Ya nei, ??

Agr ho sakta he to kitna ho ga, ??

Plz jawab zaror dein,

yes you can pay lifetime token at once now Islamabad excise is doing that, kindly visit excise office personally.

rok sako to rok lo full time mehangi ai hai

bhai ya nay pakistan ha.ab aisa hi ho ga

Its unfair,most of the people have up to 1000cc vehicles and most of them from middle class.But this government giving a relief only to upper class.

Ye hay naya Pakistan.

I have an old mercedes model E320,1998. Last year token was Rs:384/- now I have to pay Rs:12000/-. Thank you Imran Khan.

It is continuety of previous governments of elite class.First it brought amnesty scheme to make white looted money of this poor country.Now for big vehicles token fees is on annual basis,which is a minor amount and lower middle class is being forced to pay a huge amount.From the beginning our rulers are collecting taxes from lower/middle class and enjoying their lives by looting this money.

I bought mehran in 2013.I paid all taxes including professional tax.I have paid token fees regularly till to date.Now this cruel government is forcing me to pay income tax+professional tax twice for the same vehicle.It is the worst act and I strongly condemn it.I also appeal to responsible authorities to review this decision

It is continuety of previous governments of elite class.First it brought amnesty scheme to make white looted money of this poor country.Now for big vehicles token fees is on annual basis,which is a minor amount and lower middle class is being forced to pay a huge amount.From the beginning our rulers are collecting taxes from lower/middle class and enjoying their lives by looting this money.

I bought mehran in 2013.I paid all taxes including professional tax.I have paid token fees regularly till to date.Now this cruel government is forcing me to pay income tax+professional tax twice for the same vehicle.It is the worst act and I strongly condemn it.I also appeal to responsible authorities to review this decision

Ref: ETO/ISB/2019/01 Islamabad, 16th July 2019

Director,

Excise and Taxation Department,

Islamabad

Subject: Token Tax of 800 CC Car Manufactured in Year 2007

Dear Sir,

I am a filler and owner of 800 CC car, manufactured in year 2007. I am a regular Token Tax payer, which accumulates to a total of PKR 14,076/- since 2007 (copies of the same is attached for your kind information).

2. However, as per notification available on website of ETO Islamabad attached (F/A), all registered vehicles in Islamabad, having 800 CC engine has to deposit PKR 10,000/- for life time token. This amount has to be deposited irrespective of manufacturing year, which raises concern to the owners of vehicles older than 5 years and or even 10 years.

3. Therefore, it is requested to revisit the criteria of token tax for vehicles older than 5 years and 10 years, please.

Will the lifetime token for under 1000cc cars cover the previous unpaid tokens? or do we have to pay them as well?

I have 2010 model 990 cc vitz, because of one year advance

I should paid 31000 token tax or any concession ?

Request to all plz up load on citizens portal about this token/tax. Maybe primeminster take action. Thanks to all.

i think its not fair, most of people having upto 1000 cc cars belong to lower middle class so it is impossible for them to arrange such a big amount at once ,it should only be 10,000/- no income tax, no other tax.

Salam dear

Request to all plz upload on citizen portal about lifetime tokens and tax complain may be primeminster take action on this. Thanks to all.

Salam dear

Request to all plz upload on citizen portal about lifetime tokens and tax complain may be primeminster take action on this. Thanks to all.

I have bolan Suzuki 796 CC Modle 2012& I had paid already 6 years token & all taxs, now again I have to pay Life Time Token Taxs, what about my those Taxs which I had already paid.

I think life time token tax is Rs.10,000/- only

rest income tax and professional tax are for new vehicles only

Brother yesterday my friend submitted 21000 against lifetime token, incom tax and professional tax. He have a 2015 registered Mira 660cc. He is already active tax payer.

Bro

How do they verify active tax payers?

They have the data of each and every Pakistani

Its totaly unfair. A person who is already paying token on yearly basis from last five year. Why he pay all amount 31000. Why the exise department is not subtracting old payed token from this amount.

I couldnot understand why our government doing this.

It was our mistake to vote PTI. May ALLAH forgive us.

Gandu goverment

is there any advanced tax on 660 cc car of 2016 model, please reply. Thanks

Lannat Aesy Naye Pakistan pr.

Is there some relief of any Tax exemption for 10 years old car?

No

Why no relife

Govt wants to stop begging other countries for its people.

government should start fulfilling their promise of getting looted money back from thieves instead of milking the poor through fuel prices and lower middle class through 1000cc and below cars.

Totally agree with you

new pakistan mubarak ho

Are you Fia or F.I.A?

Farhan Imaan Abro (FIA)

It is a totally stupid and unjustified system.

one question main agar 31000 tokan pay kardun to kya garrenty hy k next year 21000 incomtex nahin lag kar ayga plez anser

one question main agar 31000 tokan pay kardun to kya garrenty hy k next year 21000 incomtex nahin lag kar ayga plez anser

muj ko purana pakistan lota do plz

I am PTI members Its crulity by the government. How the people pay 31000 in shape of token tax Next time we sell our vote Inshallaha. Currept people who looted the country I confirmed that they will released. This country is not suitable for poor people. A great zulm

Plz 660cc per Jo token tax rakha gaya ha us KO wapis lain ye gareeb logon k sath zulim ha

unfair and unjust for old cars

Paying tax to government is essential to country to run the system but like this it is total rejectable and zulm. Having this way it will only promote cruption and illegal means to get the token

With token tex fee ok but what is incomtex fee and professional fee and and additional fees

I think coming years we will also pay oxygen tax sunshine tax aur tax and all that Allah pak gives to his mankind as a gift

For 2005 under 1000cc car, we already paid 348 every year.. now will they deduct that paid amount or we have to pay full 31000 as life time token and income n professional tax?

Besharmo ab bhugto Naya Pakistan. Tum he logo nay PTI aur IK ko vote diya hai. Ab bhugto.

I have a fifty five years old car which was bought by my late father, was paying annual token tax of Rs. 348 which has been increased to Rs. 5000 in one go plus Rs. 7000 advance income/withholding tax, this is cruelty.

i have 15 years old car. i have paid taxes since 15 years. now even if they say that 348 rs per year will be adjusted in current date….come on i have paid that amount when USD was 55 PKR now its 160 PKR. how they can adjust the amount paid 15 years ago with same amount today. this looting of common people is not acceptable. This naya pakistan is not acceptable where our policy makers dont know any thing.

City Islamabad app not downloading in Saudi Arabia

Aoa.. I want to know is there any discount if someone pay token tax before 31st July? I heard there is discount…

Kindly reply

10% discount if token tax pay before 31st July, 2019

It is very difficult for poor people having 1000cc cultus cars 13 or 14 years old cars valuing three or four lac to pay token tax life time token in lump sum ,kindly allow them to pay yearly token tax of cars up to 1000 cc

lets say i have an older model of vehicle 20 year back. i have already paid approximate 20,000/ on account of token and taxes.

now i have to pay again 31000/ for life time token if im not filer… wt the hell thy r doing with ppl who are already hand to mouth..

wt a f****ing change….

govt gareeb awam ko mar rhi ha.kuch to khalay kray token tax pa.

SAME TAXES FOR A NEW CAR & 10 YEAR OLD CAR.

ALTHOUGH A NEW CAR IS APPROX AT HALF RATE OF OLD CAR.

FOR EXAMPLE NEW CAR = 20 LACS & SAME BRAND 10 YEAR OLD CAR = 10 LACS

TAXES ARE SAME……………………………WHAT A RULE

1.0 Engine, Model 2013 Last year Token paid 1700/= I total paid 2013 to 2019 10200/=

Govt policy 10 year bad car value down, aur 11 year ka token approx 500/=

i total paid (2013 to 2019) 10200/=

Balance (2020 to 2023) 6800/= G.total:- 17000.00

My Question?

Abb jiss nay 6year k jama karwa diaye hain wo kia kary?

check token taxes Islamabad post or visit excise department.

Govt. has targeted only small car holders which is totally unfair. Cars from 660cc to 1000 cc has been charged with toke tax of Rs. 10,000 (lifetime) while income tax of Rs. 20,000 and professional tax of Rs.1000 which is annual not life time. It means that a non-filer having vehicle from 660 cc to 1000 cc has to pay total tax of Rs. 31000 this year. For next years he has to pay 21000 every year. What the heck is this! Why income tax for small cars so high? Why we should pay income tax on cars? We didn’t vote pti to rob us in the name of such high taxes. This tax is totally rejected and we will raise our voice against this unfair policies.

It’s not like this. its life time

Life time Corruption…

Im in Saudi Arabia and send my friend to Excise and Taxation Department Islamabad to pay the token fee for my car 660cc for life time.

They have charge total RS. 21000

Income tax RS. 10000

Professional tax RS. 1000

Life Time Token 10000

But now i come to know in this article as per the fee list for 660 cc car its only RS 5000.

Life time Corruption…

I agree, those rascals charged Rs 3700 from me whereas I own a car that is 20 years old. I paid Rs 384 last year and this time they asked for Rs 3700. I don’t know where is our money going?

Mazay karo naya pakistan may GHABRANA nahi hay jb tk maeeet k takhty py na laytya dia jaye

People having vehicle up to 850 cc belong to middle class pls change your plan of life time token regarding vehicle up to 850 cc or convert it into installments.

Ye zulm hai ghareeb logon k sath.old cars pe itnay paise kahan sy laen

Its totally unfair with the poor people having vehicle up to 850 cc.my request is that said criteria and plan should be changed or subject amount related to vehicle up to 850 cc will be collected in installment. Plz change token tax plan ie life time token tax policy for vehicle up to 850cc.

Unfair….theu rmeaning nuts and stupid. If someone wants to sale his car why he shud pay life time token. Secondly fbr reimbursement process is soooo cumbersome that u can’t get back the tax u claim….stupid system.

Unfair….theu rmeaning nuts and stupid. If someone wants to sale his car why he shud pay life time token. Secondly fbr reimbursement process is soooo cumbersome that u can’t get back the tax u claim….stupid system.

Govt always target poor or middle class, but every time every where, says we rise the poors. But how??? Up to 850cc should be given some relief.

It’s unfair with people having vehicles upto 850 CC

Shouldnt give years older car be exempted from IT?

No

I am a filer, How much i have to pay for an ICT 660 CC 14 model wagon R?

1. My tokens are paid upto july 2018

2.want to transfer to my name

3. Lifetime

…can some body calculate for me?